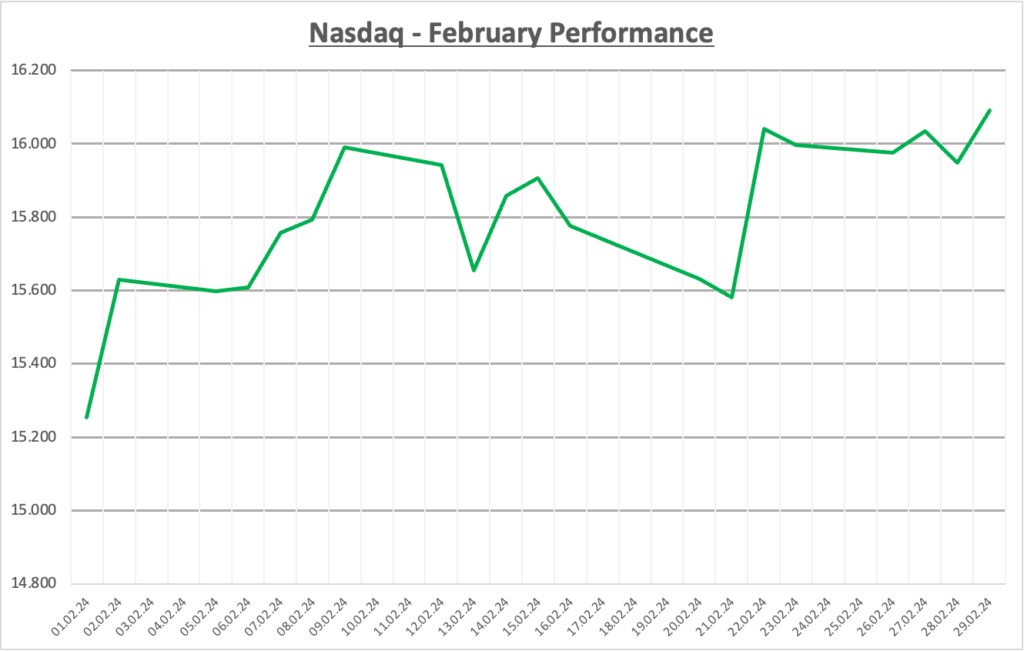

February 2024 was a month of celebration on Wall Street. All major indexes saw significant gains, with some outperforming expectations. Let’s delve deeper into the factors that fueled this rally, analyze key events, and explore the underlying concerns.

Index Performance Breakdown:

- Nasdaq (6.2%): The tech-heavy Nasdaq led the charge, bolstered by strong earnings from major technology companies like Apple, Microsoft, and Alphabet (Google’s parent company). The anticipation surrounding AI advancements further propelled the index.

- Russell 2000 & 1000 (Around 5.5% Each): These small-cap and mid-cap indexes exhibited surprising resilience. While their earnings haven’t fully recovered from the 2022 downturn, optimism about the overall economic recovery fueled their rise.

- S&P 500 (5.3%): This broad market index delivered a solid performance, reflecting the positive sentiment across various sectors. Notably, Consumer Discretionary (+8.7%) and Industrials (+7.2%) emerged as top performers, indicating increased consumer spending and industrial activity.

- Dow Jones Industrial Average (2.5%): This index, known for its composition of blue-chip companies, posted a more modest gain. This could be attributed to the Dow’s heavier weightings in value stocks, which tend to perform less dynamically during periods of market optimism.

Major Events and Their Impact:

- S&P 500 Crosses 5,000 (February 9th): This symbolic milestone triggered a wave of bullish sentiment. It signified a remarkable recovery from the lows of 2022 and cemented investor confidence in the market’s continued upswing.

- Disinflation Data Releases: Throughout February, key inflation indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) continued to show a downward trend. This validated the Fed’s belief that inflation was under control, potentially paving the way for a more accommodative monetary policy.

- Positive Federal Reserve Commentary: Fed Chair Jerome Powell’s remarks hinted at a potential slowdown in future interest rate hikes. This was interpreted by the market as a signal of continued support for economic growth and corporate profitability.

- Flash PMI Data Release (February 22nd): The S&P Global flash Purchasing Managers’ Index (PMI) provides a real-time snapshot of economic activity in the manufacturing and service sectors. A strong PMI reading in February, indicating continued expansion, fueled investor optimism about the health of the economy and boosted market confidence.

- Federal Open Market Committee (FOMC) Minutes Release (February 22nd): The release of the minutes from the January FOMC meeting offered further insight into the Fed’s policy stance. While the minutes confirmed the Fed’s intention to maintain the current interest rate, any dovish language hinting at a potential future rate cut could have further bolstered market sentiment.

- Geopolitical Tensions: While not a specific event, ongoing geopolitical tensions, particularly regarding conflicts or trade disputes, remained a source of underlying anxiety for investors in February. A significant escalation in tensions could have triggered market volatility and a flight to safety towards defensive assets like gold or bonds.

Earnings Season Scrutiny:

The tail-end of February’s earnings season yielded mixed results. While large-cap companies like Microsoft and Tesla surpassed analyst expectations, a significant portion of the S&P 500 companies reported only modest year-over-year earnings growth. The performance of small-cap companies remained concerning, with their earnings still in recessionary territory. This raised questions about the health of smaller businesses and the unevenness of the economic recovery.

AI Hype: A Double-Edged Sword

February witnessed a surge in investor interest in AI-related companies. This was fueled by advancements in the field and the potential for AI to enhance productivity and disrupt industries. While the technology holds immense promise, it’s crucial to remember that some of the hype might be speculative. Investors should carefully evaluate the specific applications and long-term viability of AI companies before making investment decisions.

Looking Forward: A Balanced Viewpoint

February’s positive performance paints a promising picture for the stock market. Disinflationary trends, solid earnings growth from large-cap companies, and technological advancements create a strong foundation for continued market growth. However, it’s essential to acknowledge the potential head- and tailwinds:

Tailwinds:

- Continued Disinflation: If disinflationary trends persist, the Fed might be less inclined to raise interest rates aggressively, potentially creating a more supportive environment for stock market growth.

- Earnings Growth: Continued solid earnings growth from large-cap companies, particularly those positioned to benefit from technological advancements, could bolster investor confidence and propel the market further.

- Technological Innovation: Continued breakthroughs and successful implementations of AI and other emerging technologies could unlock new economic opportunities, translating into higher corporate profits and market gains.

Headwinds:

- Geopolitical Uncertainty: Unforeseen geopolitical events, such as escalating conflicts or trade wars, could disrupt global supply chains and trigger market volatility.

- Small-Cap Lag: The continued struggle of small-cap companies to recover fully could raise concerns about the overall health of the economy and dampen investor enthusiasm.

- Interest Rate Trajectory: While the Fed might slow down future rate hikes, a sudden shift towards more aggressive tightening could trigger a correction in the market, especially if it outpaces investor expectations.

- Valuation Concerns: With the S&P 500 trading at a relatively high valuation compared to historical averages, there’s a risk of a correction if future earnings growth doesn’t meet expectations.

Beyond the Binary:

The market outlook is rarely a simple “bullish” or “bearish” prediction. Here are some additional factors to consider:

- Sector Rotation: Investors might shift their focus from sectors that outperformed in February to those with more attractive valuations or growth potential.

- Volatility Episodes: Even in a generally positive market, expect periods of higher volatility driven by unexpected news or data releases.

- Active Management: A more active management approach, strategically allocating assets based on evolving market conditions, might be more prudent than a passive buy-and-hold strategy.

By acknowledging both the potential opportunities and challenges that lie ahead, investors can position themselves to navigate the complexities of the market and make informed decisions that align with their risk tolerance and investment goals. Remember, staying informed and having a long-term perspective are crucial for navigating the ever-changing waters of the stock market.