In this stock analysis we will learn everything about the Lululemon stock. We will analyze Lululemon’s profitability, financial security & growth and in the end we will evaluate the share price. You can then decide whether Lululemon is a suitable investment for you or not.

Company Profile

Lululemon Athletica is a Canadian-American multinational athletic apparel retailer that sells a variety of technical athletic clothes for yoga, running, working out, and other activities. They also offer lifestyle apparel, accessories, and personal care products.

Founded in 1998, Lululemon began as a retailer focused on yoga apparel, but has since expanded its offerings. The company is known for its high-quality, albeit often higher-priced, athletic wear. Lululemon operates over 711 stores internationally and sells its products online as well.

Lululemon has faced criticism for its reliance on materials like polyester, nylon, and cotton, which can have a significant carbon footprint. The company is taking steps to become more sustainable, but this remains an ongoing area of focus.

Lululemon is active on social media and has cultivated a strong brand identity around fitness, wellness, and community.

Revenue Distribution

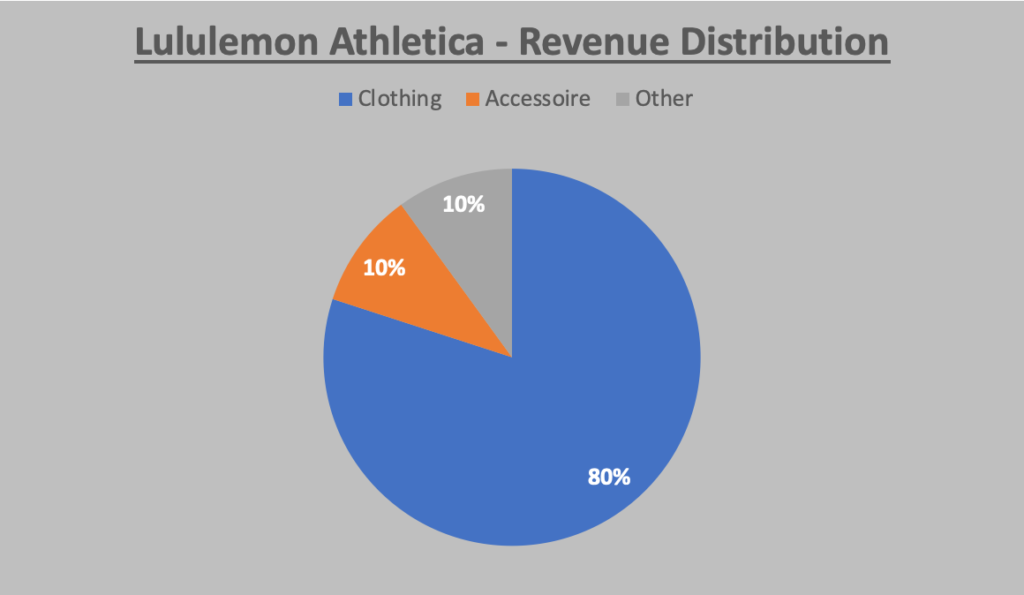

Lululemon divides its business into three divisions:

Here’s a closer look at Lululemon’s revenue distribution and some trends to watch:

- Clothing: This is the core of Lululemon’s business, and it’s where the company generates the most revenue. Lululemon’s clothing is known for its quality, performance, and style.

- Accessories: This category includes items like bags, hats, and yoga mats. Accessories are a growing part of Lululemon’s business, and the company is investing in developing new and innovative products.

- Other: This category includes a variety of items, such as footwear, personal care products, and fitness equipment. Lululemon is entering new categories with these “other” products, and it will be interesting to see how this segment develops in the future.

Future Trends:

- Continued Growth in Apparel: Lululemon is expected to continue to grow its apparel business, driven by the popularity of athletic wear and the company’s strong brand reputation.

- Expansion into Accessories and Other Categories: Lululemon is likely to continue to expand its accessories and other categories businesses. The company has a loyal customer base that is willing to spend money on Lululemon-branded products, and there is a growing market for athletic accessories and other products.

- Direct-to-Consumer Sales: Lululemon has been investing in its direct-to-consumer channels, and this trend is likely to continue. The company is opening new stores and expanding its online presence. This will allow Lululemon to build a closer relationship with its customers and sell more products at full price.

It’s important to note that this is just a general analysis, and future trends may differ. However, Lululemon is a well-established company with a strong brand, and it is well-positioned for continued growth in the athletic apparel market.

Competition

Lululemon faces competition on two fronts: established sportswear giants and up-and-coming athleisure brands. Here’s a breakdown of Lululemon’s key competitors:

Established Sportswear Brands:

- Nike and Adidas: These global giants dominate the athletic apparel market, offering a wide range of products for various sports and activities, including yoga and running. While their core focus might not be strictly athleisure, they are major players in the athletic wear space that Lululemon competes with.

- Under Armour: Another big name, Under Armour is known for its performance-oriented apparel and competes directly with Lululemon in the high-performance yoga and workout wear categories.

Up-and-Coming Athleisure Brands:

- Outdoor Voices: This brand focuses on technical innovation and sustainability, appealing to a younger, more environmentally conscious customer. They offer stylish and functional activewear at a slightly lower price point than Lululemon.

- Fabletics: This membership-based company offers trendy and affordable athleisure wear, with a focus on leggings and yoga pants. Their subscription model allows for a more cost-conscious approach to acquiring workout clothes.

- Other niche brands: Beyond Yoga, Sweaty Betty, Vuori, and Alo Yoga are some other players in the athleisure market, each with a slightly different target audience or focus (yoga-specific, eco-friendly, etc.). These brands can take a bite out of Lululemon’s market share, particularly with customers seeking specific features or price points.

Understanding these competitors allows Lululemon to maintain its competitive edge by focusing on its strengths:

- High-quality, innovative fabrics and designs

- Strong brand identity and community focus

- Excellent customer service and in-store experience

By continuing to excel in these areas and adapting to changing consumer preferences, Lululemon can stay ahead of the competition in the ever-evolving athleisure market.

Profitability – Lululemon

The first analysis to determine the intrinsic value is profitability.

Stocks with a competitive advantage generate high profit margins, do not require a lot of capital and stand out from the competition. In other words, stocks with a competitive advantage are more profitable than the competition.

To determine this, we first look at the income statement, analyze it, compare the profit margins with the competition and calculate how capital-intensive the business is compared to the competition.

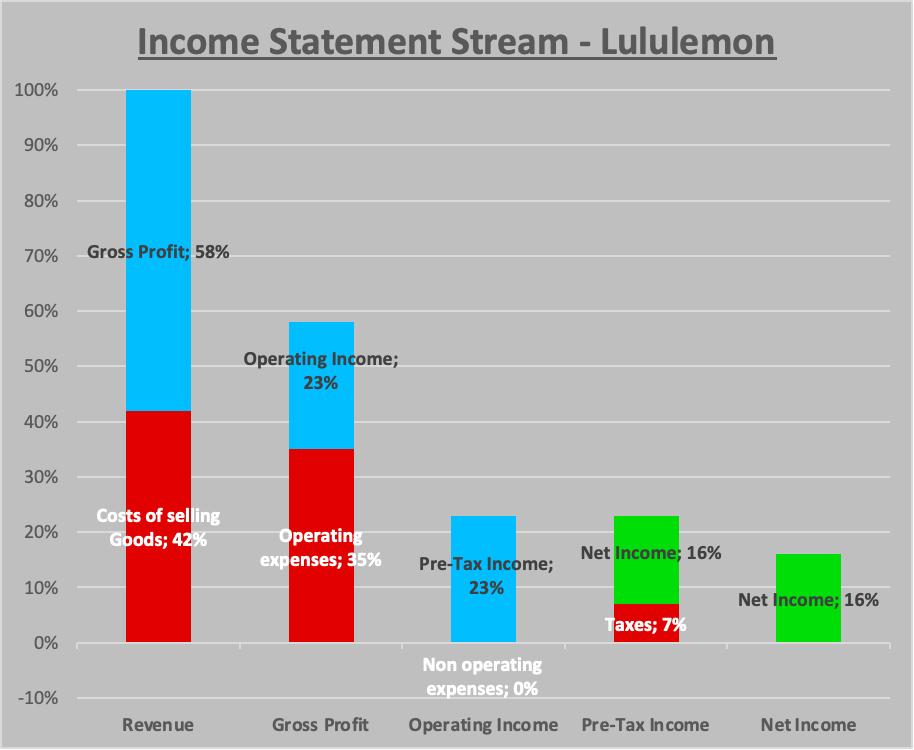

To do this, we take a closer look at the income statement and start by analyzing how much revenue was generated, what costs accrued and what profits were achieved as a result. Here is the income statement stream from Lululemon:

In the last four quarters, Lululemon generated sales of around $9.6 billion, with revenue costs of around $4 billion. The approximately $3.4 billion in operating expenses are almost entirely made of administrative costs. The non-operating costs and earnings cancel each other out and have no larger effect on profits. After taxes, Lululemon achieved a profit of 1.55 billion dollars.

Profit Margins

The various margins are of particular interest in the income statement analysis. The higher the margins compared to the competition, the greater the competitive advantage. The emphasis here is on competitive comparison, as companies from the sportswear industry cannot be compared with technology companies such as Microsoft. A comparison only makes sense if the products and services are comparable.

Lululemon achieves better margins than its competitors:

| Lululemon | Nike | Adidas | Under Armour | |

| Gross Margin | 58.31% | 43.96% | 47.52% | 45.73% |

| Operating Margin | 22.95% | 11.76% | 1.26% | 4.71% |

| Net Profit Margin | 16.12% | 10.28% | -0.38% | 6.89% |

Margins from the income statement give us an indication of the profitability of a company. Basically, it can be said that the better the margins compared to the competition, the higher the profitability and the greater the competitive advantage.

However, as already mentioned, the products and services must be comparable with each other. Even if there are many overlaps in this competitive comparison, they are all unique and a comparison should only be made with caution.

Return on Assets

Return on assets (ROA for short) is the most important key figure for analyzing a company’s profitability. ROA is calculated by dividing the profits by the total assets. It shows how much profit a company generates from its assets. The higher the ROA compared to the competition, the better the company’s earning power.

Here is the ROA comparison between Lululemon and its competitors:

| Lululemon | Nike | Adidas | Under Armour | |

| ROA | 25.59% | 13.97% | -0.42% | 8.27% |

As you can see, Lululemon has by far the best ROA. For now Lululemon has a competitive advantage.

Financial Security – Lululemon

After analyzing the profitability, the second analysis for determining the intrinsic value is the financial security of a company. This is because companies that are financially secure and solidly financed give us investors a level of security. While the income statement provides us with information about the operating business, the balance sheet shows us how the company is financed.

To assess the financial security of a company, it is important to look at the ratio between equity and debt. In addition, the company should be able to cope with short-term financial burdens. The debt to equity ratio and the cash ratio are two key figures that can help us with this.

The debt to equity ratio shows the relationship between long-term debt and equity. The cash ratio shows how well short-term liabilities are covered by cash, bank and similar assets. Here is the development of the mentioned KPIs for Lululemon:

| Cash Ratio | Debt to Equity | |

| 2021 | 1.3 | 0.31 |

| 2022 | 0.9 | 0.32 |

| 2023 | 0.77 | 0.34 |

| 2024 | 1.38 | 0.33 |

This means that current liabilities are well covered and the company is largely self-financed. This is an indicator of a high level of financial security. To put financial security into perspective, here is a comparison with the competition:

| Lululemon | Nike | Adidas | Under Armour | |

| Cash Ratio | 1.38 | 1.17 | 0.28 | 0.71 |

| Debt to Equity | 0.33 | 0.85 | 1.22 | 0.68 |

As this comparison clearly shows, Lululemon has a high level of financial security. Compared to its competitors, its current liabilities are the best secured and its debt ratio is the lowest.

Growth – Lululemon

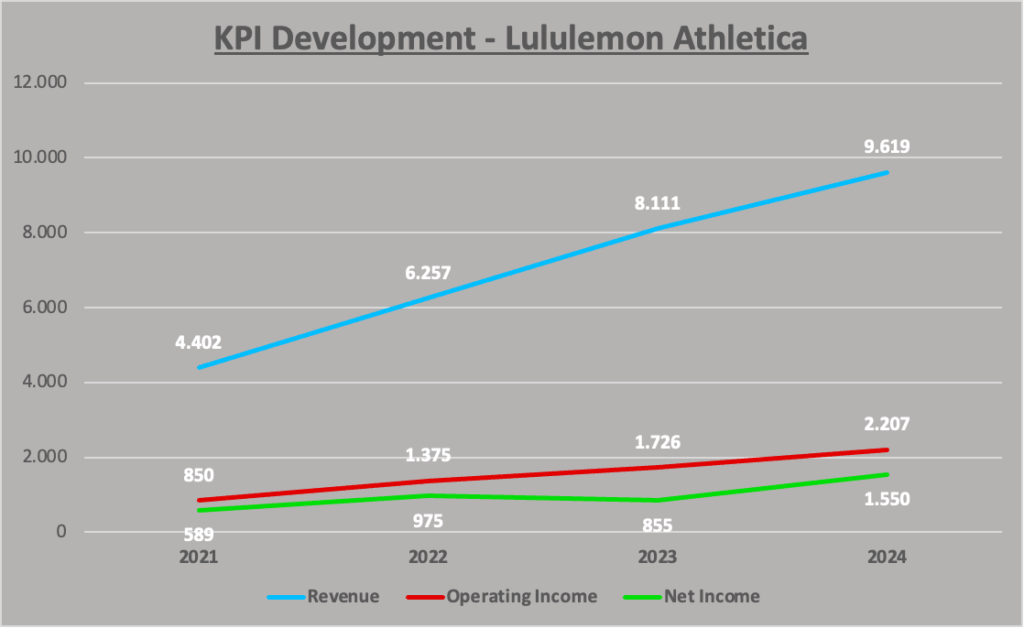

Analyzing company performance is an important part of value investing. It makes it possible to draw conclusions for the future from the past. The income statement provides important information about the development of the company.

Here is the development of revenue, operating income and net income from 2021 to 2024:

In the period from 2021 to 2024, Lululemon has achieved an increase in sales of +119%, with a significant operating growth combined with a profit increase to around 1.55 bn $.

Lululemon’s growth compares favorably with its competitors:

| 2020 to TTM | Lululemon | Nike | Adidas | Under Armour |

| Revenue Growth | +119% | +38% | +3% | +29% |

| Operating Growth | +160% | +90% | -72% | n/a |

| Net Income Growth | +163% | +106% | -100% | n/a |

The development of KPIs can provide information about the future development of a company. Although past growth is no guarantee of future growth, companies with a strong performance will generally continue to grow in the future. Companies whose sales and profits are falling, on the other hand, will generally also fall in the future. To create a more accurate forecast, you should also consider the revenue distribution in addition to the KPI development.

Share Price & Forecasts

Now that we have analyzed and evaluated the Lululemon share, it is time to assess the current price of the share.

The share price is determined by supply and demand. Supply is determined by the company and the shareholders. Demand is determined in the long term by the earnings per share. The more profit a share generates, the more interesting it is for investors.

The P/E ratio, also known as the price/earnings ratio, shows the relationship between the share price and the earnings per share. For example, a P/E ratio of 20 means that a share with a price of $20 has earnings per share of one dollar. (Price = P/E ratio * earnings per share)

The lower the P/E ratio, the better the investment. Unfortunately, this cannot be said across the board, as future developments and forecasts play a very important role.

Earnings per Share – Lululemon

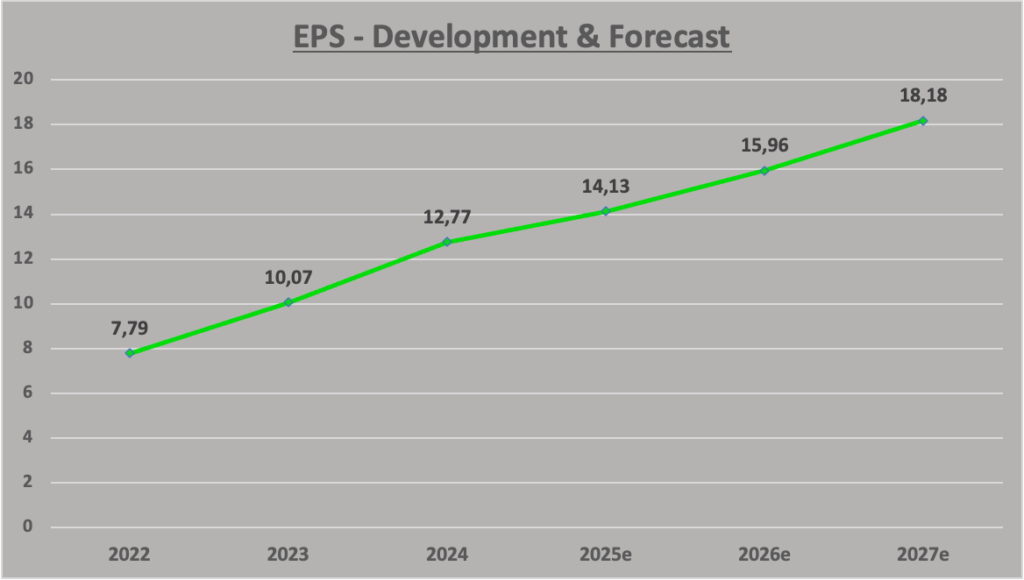

Let’s take a look at the development and forecasts for Lululemon’s earnings per share (EPS):

EPS of $12.77 is reported for 2024 and the expected values for 2025 to 2027 also mean a significant increase in earnings. With the base value of 2024, Lululemon would achieve an increase of +42% to 18.18$. Based on our analysis, this growth seems plausible. But earnings per share are only half the story, let’s look at the P/E ratio.

P/E Ratio Development – Lululemon

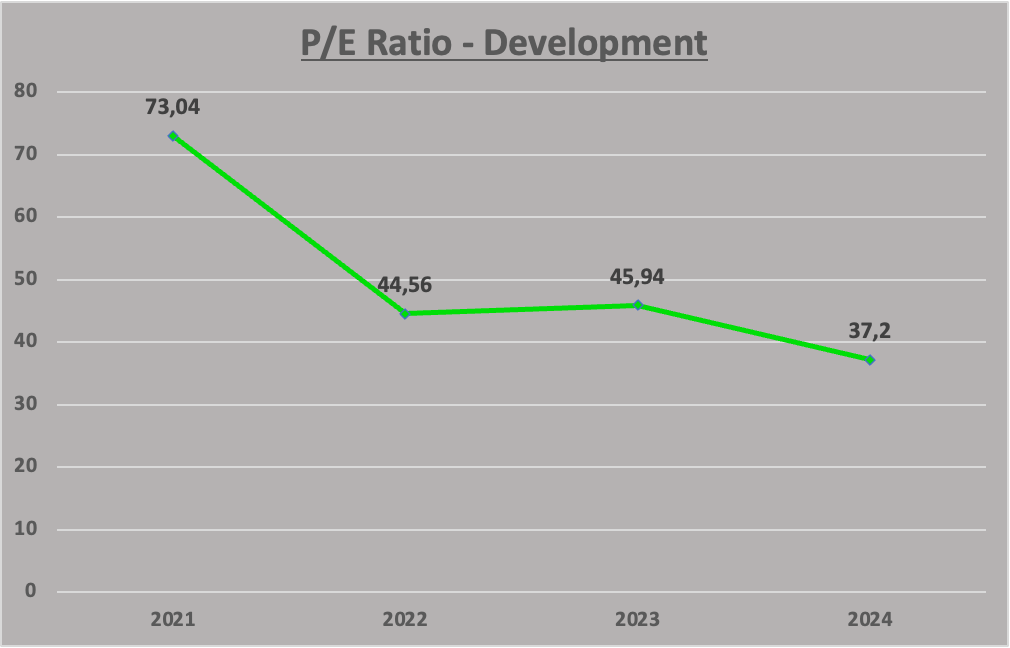

Here is the development of Lululemon’s P/E ratio from 2021 to 2024:

A P/E ratio of less than 20 is considered undervalued, a P/E ratio of more than 25 is considered overvalued. Lululemon has a P/E ratio of around 37. This would mean that the share is overvalued.

Over the last four years, Lululemon’s average P/E ratio is around 50, which means it is generally overvalued. To get a more accurate valuation, we should link the P/E ratio with EPS.

Share Price – Forecast

First, we link the EPS forecasts with Lululemon’s P/E ratios. In the first scenario, we assume that demand for Lululemon shares will remain the same over the next few years. This would result in the following share price forecasts:

| EPS-Forecast | P/E Ratio | Share Price – Forecast | |

| 2025e | 14.13$ | 37.2 | 525$ |

| 2026e | 15.96$ | 37.2 | 593$ |

| 2027e | 18.18$ | 37.2 | 676$ |

Lululemon’s share price currently stands at $390.65 (as of 30.03.2024). Based on this scenario, Lululemons share price performance looks good. To be precise, an increase in value of around 73% by 2027.

In a second scenario, we expect demand to be conservative, so we assume a P/E ratio of 20-25, which can generally be considered fair.

| EPS-Forecast | P/E Ratio | Share Price – Forecast | |

| 2025e | 14.13$ | 20-25 | 282$-353$ |

| 2026e | 15.96$ | 20-25 | 319$-399$ |

| 2027e | 18.18$ | 20-25 | 363$-454$ |

In this scenario, Lululemon would potentially experience a slight increase in value of around 16%.

Summary

Lululemon’s athletic apparel empire continues to impress, but is the current stock price a reflection of this success or a sign of overvaluation? This in-depth analysis explores Lululemon’s financial health, growth potential, and current valuation to help you decide if it’s a worthy addition to your portfolio.

Dominating the Athleisure Market

Lululemon has carved a niche in the activewear market, transitioning from yoga apparel to a broader range of stylish and functional workout wear. Their focus on high-quality materials, innovative designs, and a strong brand identity built around fitness and wellness has cultivated a loyal customer base. While giants like Nike and Adidas offer a wider range of athletic products, Lululemon excels in the specific athleisure segment.

Financial Strength: A Competitive Edge

Lululemon boasts impressive financial performance. Here’s a closer look:

- Profitability: Compared to competitors, Lululemon enjoys significantly higher gross and net profit margins. This indicates a strong competitive advantage, allowing them to retain a larger portion of revenue as profit.

- Growth: The company has experienced exceptional revenue and profit growth in recent years, showcasing a successful business model and strong market demand for their products.

- Financial Security: Lululemon maintains a solid financial position with low debt levels and healthy cash flow coverage. This financial security provides a buffer against unforeseen economic challenges.

Share Price & Forecasts: A High Valuation?

The analysis acknowledges that the current P/E ratio suggests the stock might be overvalued compared to historical averages. While future earnings per share (EPS) forecasts are positive, the share price might need to adjust based on investor demand.

Disclaimer

This article is not financial advice and does not constitute a recommendation to buy or sell stocks. The information in this article is based on the personal opinions of the author and should not be construed as investment advice.

The author assumes no liability for any damages resulting from the use of the information in this article. Readers should inform themselves independently before investing in stocks and only make an investment decision after their own examination. An investment in shares can lead to a total loss of capital.

All figures on Lululemon and the share are from Gurufocus.

Gurufocus offers a comprehensive and intuitive platform that simplifies our work as value investors. With comprehensive financial data and a stock screener with more than 500 filters, you can quickly find the right stocks and analyze them immediately. It is my absolute go-to tool for my stock analysis and you can test it for 7 days free of charge and see for yourself.